Low-Density Polyethylene (LDPE) Market Trends | Asia-Pacific Leads with 50.55% Share | DataM Intelligence

Low-Density Polyethylene market is led by Asia-Pacific with 50.55% share in 2024. Packaging dominates as top end-user industry, holding 64.70% market share.

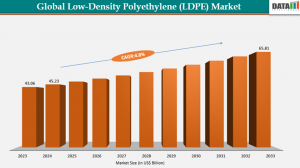

NEW JERSEY, NJ, UNITED STATES, September 25, 2025 /EINPresswire.com/ -- The Global Low-Density Polyethylene (LDPE) Market has exceeded USD 45.23 Billion, a growth primarily driven by accelerated demand for flexible packaging solutions from the expanding e-commerce sector.The global Low-Density Polyethylene (LDPE) market was valued at USD 45.23 billion in 2024 and is expected to reach USD 65.81 billion by the end of 2032.

In the agricultural sector, LDPE's application in greenhouse films and irrigation systems is pivotal. With the global food production requirement projected to increase by 60% by 2050, LDPE-based solutions enhance crop yields and resource efficiency. Agricultural applications represent a growing market segment projected at a CAGR of 4.7% from 2024 to 2032.

Despite positive growth indicators, the market faces notable challenges. High energy consumption in LDPE production leads to elevated operational costs. Production processes like the autoclave method are particularly energy-intensive, impacting profit margins, especially where energy prices are volatile.

Download Latest Sample of This Strategic Report@ https://www.datamintelligence.com/download-sample/low-density-polyethylene-market

Technological advancements are also unlocking new opportunities, enabling enhanced LDPE manufacturing efficiency, reduced production costs, and improved product performance. Innovations in catalyst technology and extrusion processes are pivotal in advancing LDPE applications.

A significant market trend is the increased focus on circular economy practices. Recycling and reuse of LDPE materials are becoming industry standards, encouraged by both consumer awareness and regulatory frameworks. This shift is anticipated to support long-term sustainability and mitigate environmental impact.

Prominent market players are pursuing aggressive strategies, such as mergers and acquisitions, capacity expansions, and strategic partnerships to consolidate their market position. The emphasis on sustainability and innovation remains critical for maintaining competitiveness.

Rapid packaging demand growth due to rising e-commerce activities worldwide

The global surge in e-commerce represents a fundamental growth driver for the Low-Density Polyethylene (LDPE) market. E-commerce sales. This robust growth is largely fuelled by increased internet penetration, smartphone usage, and shifting consumer behaviours toward online shopping, further accelerated by the COVID-19 pandemic.

LDPE plays a critical role in the packaging ecosystem, especially in flexible packaging applications such as films, bags, stretch films, and shrink wraps. In 2024, the films & sheets product type accounts for over 58.8% of the total LDPE market share, underlining its dominance.

LDPE films are highly favoured in packaging because they offer flexibility, moisture resistance, and high puncture strength, ensuring efficient protection during the storage and transit of goods. The rising volume of e-commerce shipments intensifies the demand for cost-effective, lightweight, and durable packaging solutions, driving LDPE consumption.

Markets in Asia-Pacific, particularly China and India, are key contributors, driven by their large consumer base and expanding logistics networks. In addition, North America maintains a significant market share, led by advanced supply chain practices and high per capita consumption of packaged goods.

Industry leaders such as ExxonMobil, SABIC, and DowDuPont are continuously innovating to meet this demand by developing thinner, stronger LDPE films and investing in sustainable solutions.

High energy consumption in LDPE production increases overall operational costs

The Low-Density Polyethylene (LDPE) market has a significantly high energy consumption associated with its production process, particularly when using the tubular and autoclave polymerization methods. Energy costs represent a substantial portion of total production expenses, often accounting for 40% to 60% of operational costs, depending on regional energy prices and production efficiency.

LDPE is produced by the high-pressure free radical polymerization of ethylene, a process that requires substantial energy input to maintain the necessary reaction conditions. Temperatures typically exceed 200°C and pressures reach up to 3,000 bars in the tubular method, while the autoclave process similarly demands high pressure and elevated temperatures. These extreme conditions result in considerable energy usage per unit of polymer produced.

Global energy price volatility further exacerbates this challenge. For instance, in 2023, crude oil prices fluctuated between USD 80 and USD 120 per barrel, and natural gas prices in North America saw a variation of USD 5 to USD 10 per MMBtu, depending on geopolitical factors and seasonal demand. Regions lacking domestic energy production face significantly higher costs, directly impacting profit margins and making it harder to compete on pricing.

Energy-intensive processes raise carbon emissions, further complicating compliance with increasingly stringent environmental regulations such as the European Union’s Green Deal and the Circular Economy Action Plan. To mitigate these challenges, LDPE producers are investing in energy-efficient technologies, including advanced reactor designs and process control systems, which can improve energy utilization by up to 10-15% per annum

North America is fuelled by strong end-use demand, technological advancement, and a growing emphasis on sustainability

North American market growth is primarily driven by its well-established industrial base, advanced infrastructure, and technological innovation in manufacturing processes.

The United States remains the largest contributor within the region, accounting for about 18% of the global LDPE market, supported by extensive applications in packaging, construction, and electrical insulation.

The packaging industry dominates North America’s LDPE consumption, contributing around 60% of regional usage. E-commerce growth, particularly in the U.S., remains robust, driving demand for flexible packaging materials that offer durability and reduced material weight.

From a manufacturing perspective, the region favours the Tubular Method, accounting for over 70% of local production, due to its efficiency and scalability. The United States benefits from competitive energy prices owing to domestic natural gas production, which significantly lowers operational costs compared to Europe and Asia.

Key players operating in North America include ExxonMobil, DowDuPont, Westlake Chemical, and Chevron Phillips Chemical, leveraging regional competitive advantages such as advanced R&D facilities and regulatory support.

Environmental sustainability is a critical focus, with the U.S. market aligning with the Circular Economy Action Plan and promoting recycling of LDPE products. Recycled content in packaging materials is expected to reach 12% by 2028, driven by consumer and regulatory demands.

A Frenzy of Competition and Collaboration Defines the Market Landscape

The competitive landscape of the Low-Density Polyethylene (LDPE) market is a dynamic arena of rivalry, strategic partnerships, and technological advancement. It brings together legacy chemical giants, emerging regional producers, and vertically integrated petrochemical conglomerates, all striving to lead in the rapidly evolving global plastics industry.

• Global Chemical Powerhouses (BASF SE, Dow, SABIC, TotalEnergies, INEOS Group, LyondellBasell Industries): These industry leaders leverage vast production capacities, advanced R&D capabilities, and global distribution networks to strengthen their LDPE portfolios. Their strategies include continuous process optimization, development of high-performance and specialty grades, and investment in sustainable solutions such as bio-based polymers and chemical recycling technologies.

• Integrated Petrochemical Conglomerates (ExxonMobil Corporation, Chevron Phillips Chemical Company LLC, Reliance Industries Limited, Petkim Petrokimya Holding A.S.): Capitalizing on fully integrated upstream and downstream operations, these players optimize feedstock supply and production efficiency. They focus on enhancing economies of scale, expanding production capacities in emerging markets, and investing in technological upgrades to improve yield and reduce environmental impact.

• Regional and Specialty Producers (Borealis AG, LG Chem, Braskem SA, Westlake Chemical Corporation): These firms differentiate themselves through flexible production setups and strong regional presence, particularly in fast-growing markets such as Asia-Pacific and Latin America. Their competitive advantage lies in developing customized LDPE solutions tailored to customer-specific applications in packaging, agriculture, and construction.

• Sustainability and Innovation as Core Drivers: In a world increasingly driven by environmental regulations and consumer awareness, market players are ramping up investments in sustainable LDPE solutions. Key trends include advancing chemical recycling, producing low-carbon and bio-based LDPE grades, and integrating digital solutions for smarter supply chain management and process control.

In this complex market ecosystem, collaboration is as critical as competition. Strategic partnerships are forming across industry boundaries, petrochemical giants co-develop innovative recycling technologies with specialized recyclers, regional producers partner with technology providers to deploy advanced process control systems, and joint ventures emerge to build sustainable LDPE production plants. These alliances are pivotal in sharing investment risks, enhancing technological know-how, and accelerating market adoption of sustainable solutions faster than any single player could achieve independently.

Looking for in-depth insights? Grab the full report: https://www.datamintelligence.com/buy-now-page?report=low-density-polyethylene-market

Why Choose This Global Low-Density Polyethylene (LDPE) Market Report

For investors, corporate strategists, policymakers, and industry participants, navigating the rapidly evolving global LDPE market requires deep, actionable insights. This comprehensive report serves as a critical roadmap, offering:

• Granular Market Intelligence: Detailed assessment of market size, growth forecasts (CAGR), and segment-by-segment analysis (by product type, manufacturing process, feedstock, end-use industry, and region) through 2032, providing a complete view of the opportunity landscape.

• Regulatory Intelligence: In-depth, actionable analysis of key regulations impacting the LDPE market, including environmental compliance standards, plastic waste management policies, extended producer responsibility (EPR), chemical recycling mandates, and global trade regulations affecting feedstock and polymer trade flows.

• Competitive Benchmarking: Thorough evaluation of business strategies, production capacities, investment plans, and market share of leading established players and emerging regional producers, enabling informed competitive positioning.

• Investment and Opportunity Mapping: Identification of high-growth applications and emerging profit pools in packaging, films & sheets, wire & cable insulation, and other sectors, as well as insights on high-growth regional markets such as North America, Asia Pacific, and Europe.

• Supply Chain Strategy: Critical analysis of cost structures, feedstock availability, key bottlenecks, supply dependencies, and opportunities across the value chain, covering naphtha, ethylene feedstock, manufacturing technologies, and downstream logistics.

• Expert, Forward-Looking Insights: Strategic recommendations and insights derived from industry specialists with deep expertise in polymer markets, petrochemical trends, regulatory frameworks, and supply chain dynamics, designed to inform high-stakes investment, market entry, and corporate growth decisions.

Get Corporate Access to Live Low-Density Polyethylene (LDPE) Industry Intelligence Database: https://www.datamintelligence.com/reports-subscription

Related Reports:

The global polymer fillers market size was worth US$ 36.24 billion in 2023 and is estimated to reach US$ 51.27 billion by 2031, growing at a CAGR of 4.43% during the forecast period (2024-2031).

Global HDPE Containers Market reached US$ 55.8 billion in 2022 and is expected to reach US$ 67.5 billion by 2030, growing with a CAGR of 2.4% during the forecast period 2023-2030.

Sai Kumar

DataM Intelligence 4market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.