Industrial Valve Market Size USD 121.43 Billion 2032 - Growth, Opportunities & Forecast 2025-2032

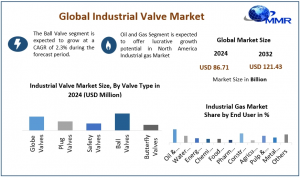

The Industrial Valve Market, valued at USD 86.71 billion in 2024, is set to grow at a CAGR of 4.3% to USD 121.43 billion by 2032.

As demand for energy-efficient, IoT-enabled, and sustainable industrial valve rises, leading manufacturers like Emerson and Flowserve are pioneering innovations, reshaping global market dynamics.”

WILMINGTON, DE, UNITED STATES, September 25, 2025 /EINPresswire.com/ -- Industrial Valve Market, valued at USD 86.71 billion in 2024, is set to grow at a CAGR of 4.3% to USD 121.43 billion by 2032. Driven by automation, IoT-enabled valves, and global infrastructure growth. Key players include Emerson, Flowserve, and Cameron.— Dharti Raut

Global Industrial Valve Market is set for steady growth, driven by rapid industrialization, infrastructure development, and increasing demand for automation across multiple sectors. Key industries, including oil & gas, water & wastewater treatment, chemicals, energy & power, and food & beverages, are adopting advanced valve technologies to improve operational efficiency and reduce downtime. North America remains a leading market, supported by significant investments in water treatment infrastructure and industrial expansion, while the Asia Pacific region is emerging as a high-growth hub, fueled by large-scale pipeline projects, smart valve adoption, and growing industrial activity. These trends highlight significant opportunities for innovation and long-term sustainable growth in the global Industrial Valve market.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/16925/

Industrial valve Market Drivers Fueling Global Expansion

The industrial valve market is driven by regional economic activity, infrastructure expansion, and evolving industrial demands. Emerging economies, particularly China and India, are experiencing rapid growth due to large-scale infrastructure projects and accelerated industrialization, boosting demand for new valve installations. Meanwhile, developed regions like North America and Europe prioritize valve replacements and aftermarket services to enhance operational efficiency. Industry-specific trends further influence market dynamics: the shale gas boom in North America increases the need for high-performance pipeline valves, while Asia’s leadership in semiconductor manufacturing drives demand for ultra-pure engineered-plastic chemical valves. In 2024, the Asia Pacific region accounted for over 38% of the global industrial valve market, highlighting the region’s strong influence on market growth and demand patterns.

Export Trends and Industrial valve Market Challenges

Despite global uncertainties, U.S. manufacturers maintain a dominant presence, exporting over USD 10 billion in industrial valves annually to regions such as Canada, Mexico, South Korea, and the Middle East. The growth of smart valves is increasingly driven by IoT integration and automation, enabling predictive maintenance, remote monitoring, and enhanced operational efficiency. However, the market faces challenges including supply chain complexities, price fluctuations, and the need for skilled technical support. Globally, more than 1,500 exporters manage over 33,000 shipments annually, with India emerging as a key export hub, reflecting its rising significance in international trade. Looking forward, technological innovations in digital integration, smart valve solutions, and predictive systems are expected to transform efficiency and safety standards, creating both opportunities and hurdles for manufacturers in this rapidly evolving market.

Diverse Valve Segments Reshaping Market Demand

The global industrial valve market is segmented by type, material, size, and industry, reflecting a diverse and evolving landscape driven by performance, application, and innovation. Ball valves lead the market, accounting for nearly 30% of revenue in 2024, valued for their durability and efficiency in high-pressure and high-temperature environments. Butterfly valves, holding a 20% market share, are widely adopted in water and wastewater management, while globe valves (18%) and gate valves (15%) are critical in the oil & gas and petrochemical sectors. Safety valves are witnessing rapid growth due to heightened demand in risk-sensitive industries.

Material-based segmentation includes cast iron, stainless steel, cryogenic, and alloy-based valves, while size-based demand spans from compact valves under 1 inch to large 50-inch solutions for heavy-duty infrastructure. Industry applications cover oil & gas, water & wastewater, energy & power, chemicals, food & beverages, pulp & paper, mining, and other sectors. The adoption of automation and IoT-enabled predictive systems is accelerating the growth of smart industrial valves, enabling improved operational efficiency, predictive maintenance, and seamless integration across industrial and automotive applications.

Feel free to request a complimentary sample copy or view a summary of the report @ https://www.maximizemarketresearch.com/request-sample/16925/

Trending Hotspots Driving Industrial Valve Market

The North America industrial valve market dominates the global landscape in 2024, driven by concentrated manufacturing hubs in the Southwest and Great Lakes regions. The Southwest, hosting 23.1% of U.S. valve manufacturers, serves as a key nexus for oil, gas, and petrochemical industries, with states like Texas and Louisiana leveraging robust infrastructure and proximity to pipelines and refineries to meet domestic and export demand. The Great Lakes region, representing 16.8% of industry establishments, supports automotive, aerospace, and heavy machinery sectors, with trade access to Canada contributing nearly 19% of U.S. industrial valve exports.

In Asia Pacific, particularly China and India, rapid industrialization, pipeline expansion, and smart valve adoption are driving industrial valve market growth. Europe remains strong with energy efficiency mandates and modernization projects shaping demand. Overall, regional hubs and emerging economies act as pivotal drivers of global industrial valve market expansion, offering opportunities for innovation, investment, and adoption of advanced, IoT-enabled industrial valve.

Key Industrial Valve Market Moves Shaping 2025

March 2024, Rotork plc Strengthens Market Position: Rotork plc completed the acquisition of Noah Actuation, marking a significant merger & acquisition in industrial valve. This strategic move expands the company’s global reach and enhances the industrial valve market expansion, while driving industry developments in smart actuation and automation solutions.

November 2024, IoT-Integrated Valve Launch: A leading valve manufacturer introduced a series of IoT-enabled industrial valve, showcasing key industrial valve market innovations. The launch demonstrates the growing trend of new product launches in industrial valve and underscores strategic partnerships in industrial valve to deliver connected, predictive maintenance solutions across energy, water, and chemical sectors.

Competitive Landscape Shaping the Industrial Valve Market

The industrial valve market key players landscape is highly fragmented, with nearly 700 manufacturers operating across the United States. Despite this, the four largest companies—Parker-Hannifin, Emerson Electric Industrial valve, Cameron International, and Flowserve Corporation—collectively account for less than 20% of market revenue, underscoring intense competition. While global giants like Emerson and Cameron diversify into automation and oilfield services, small to mid-sized firms focus exclusively on specialized valve production, driving innovation and niche growth.

Technological advancements in product development remain a crucial competitive factor, with companies emphasizing precision, durability, and smart valve integration to enhance operational efficiency. Pricing strategies vary, with complex and high-performance valves prioritized over commodity solutions. Reliability and supplementary services, such as design consulting and after-sales support, distinguish leading manufacturers in the market. Regional players, including AVK Group industrial valve expansion, further intensify competition, ensuring continuous innovation across North America, Europe, and Asia, while shaping future industrial valve market share trends.

Industrial Valve Market Key Players

North America

Emerson (USA)

Weir Group PLC (USA)

Flowserve Corporation (USA)

Cameron - Schlumberger (USA/Switzerland)

Dwyer Instruments (USA)

McWane, Inc. (USA)

Swagelok (USA)

Curtiss-Wright Corporation (USA)

GE Valve (USA)

Europe

IMI PLC (UK)

Spirax Sarco (UK)

Crane Co. (UK)

Kitz Corporation (Germany)

Velan Inc. (France)

Samson AG (Germany)

AVK Holding A/S (Denmark)

Ham–Let (Israel)

Alfa Laval (Sweden)

Rotork (UK)

KSB SE & Co. KGaA (Germany)

Asia Pacific

Neway Valve (Suzhou) Co., Ltd. (China)

KIM Valves (India)

Apollo Valves (India)

Avcon Controls (India)

Metso Corporation (Finland)

The global industrial valve market is poised for robust expansion, driven by industrialization, infrastructure development, and automation adoption. Key players like Emerson and Flowserve lead innovation in smart and IoT-enabled valves. North America dominates, while Asia Pacific emerges as a growth hub. Market opportunities span oil & gas, water, energy, and chemical sectors, highlighting significant industrial valve market expansion and technological advancements.

Industrial Valve Market FAQs

What is the current size of the global industrial valve market?

Ans. The global industrial valve market size in 2024 is valued at USD 86.71 billion, with projections to reach USD 121.43 billion by 2032, driven by industrialization, infrastructure growth, and automation across multiple sectors.

Which regions dominate the industrial valve industry?

Ans. North America holds the highest market share, followed by Asia Pacific and Europe. Emerging economies like China and India are fueling market expansion through pipeline infrastructure and smart valve adoption.

Who are the key players in the industrial valve market?

Ans. Leading industrial valve manufacturers include Emerson, Flowserve Corporation, Cameron - Schlumberger, IMI PLC, AVK Holding, and Weir Group PLC, focusing on innovation, smart valves, and global market expansion.

Related Reports:

Valve Cover Gasket Market https://www.maximizemarketresearch.com/market-report/global-valve-cover-gasket-market/87335/

Control Valve Market: https://www.maximizemarketresearch.com/market-report/global-control-valve-market/17135/

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

Lumawant Godage

MAXIMIZE MARKET RESEARCH PVT. LTD.

+ +91 96073 65656

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.